How to get a PERFECT credit score!

The proof is in the pudding! 999 gang and my score has stayed the same!

I’m back with another #MoneyTalk blog and in this post, I’ll be talking CREDIT SCORES! Don’t worry, It’s not as scary as it sounds and by the end of this, you’ll have a better idea of how to build your credit, no matter what stage you’re at!

As someone who has managed to maintain a perfect credit score for a long time, I get asked all the time about how I’ve managed to reach and maintain an excellent score. Since we’re in a new year and I want everyone to win, I’ve decided to share some tried and tested tips to boost your score this year! Hopefully, more of you can join me in the elite gang and use it to your advantage too! In this post, I’ll break down as much as I can and give tips to those in different positions so buckle up, I’ve got you covered!

What is a credit score?

In simple terms, it’s a numerical score that determines someone’s creditworthiness and directly affects how much you will be loaned and your repayment offers. It’s the number lenders will use before offering you a loan/contract/other financial services. This number is based on your credit history and your financial habits. It looks at the accounts you hold, your borrowing to date, any debts, your repayment history, and many other things; all of which can make or break your credibility.

Why should I know my score?

It’s important to know the state of your financial health and to monitor it when you can. It’s important as little things such as misinformation/ fraudulent applications can negatively impact your score. Trust me, you do not want to fall victim to false information when you are trying to apply for a mortgage only to find out that something so small was not challenged or amended. In monitoring your score, you can see how your decisions affect your score, and if there is a significant drop (or rise) that doesn’t make sense, you can investigate this further and get offending causes off your report. It’s also good to know your score so that you aren't at risk of being rejected when seeking a loan or contract as a rejected loan also adds to a negative score… I know I know!

So how can I check my score for free?

There are multiple sites that allow you to check your score. In the UK, the most used and trusted credit score checker is Experian. You can access the free version which will just tell you your score, but if you want to view your report, you’ll have to sign up to view it. This feature comes at a cost but there is a 30-day free trial available so if your score is low or has changed dramatically without any explanation, It may be worth looking deeper into your report and questioning any suspicious activity.

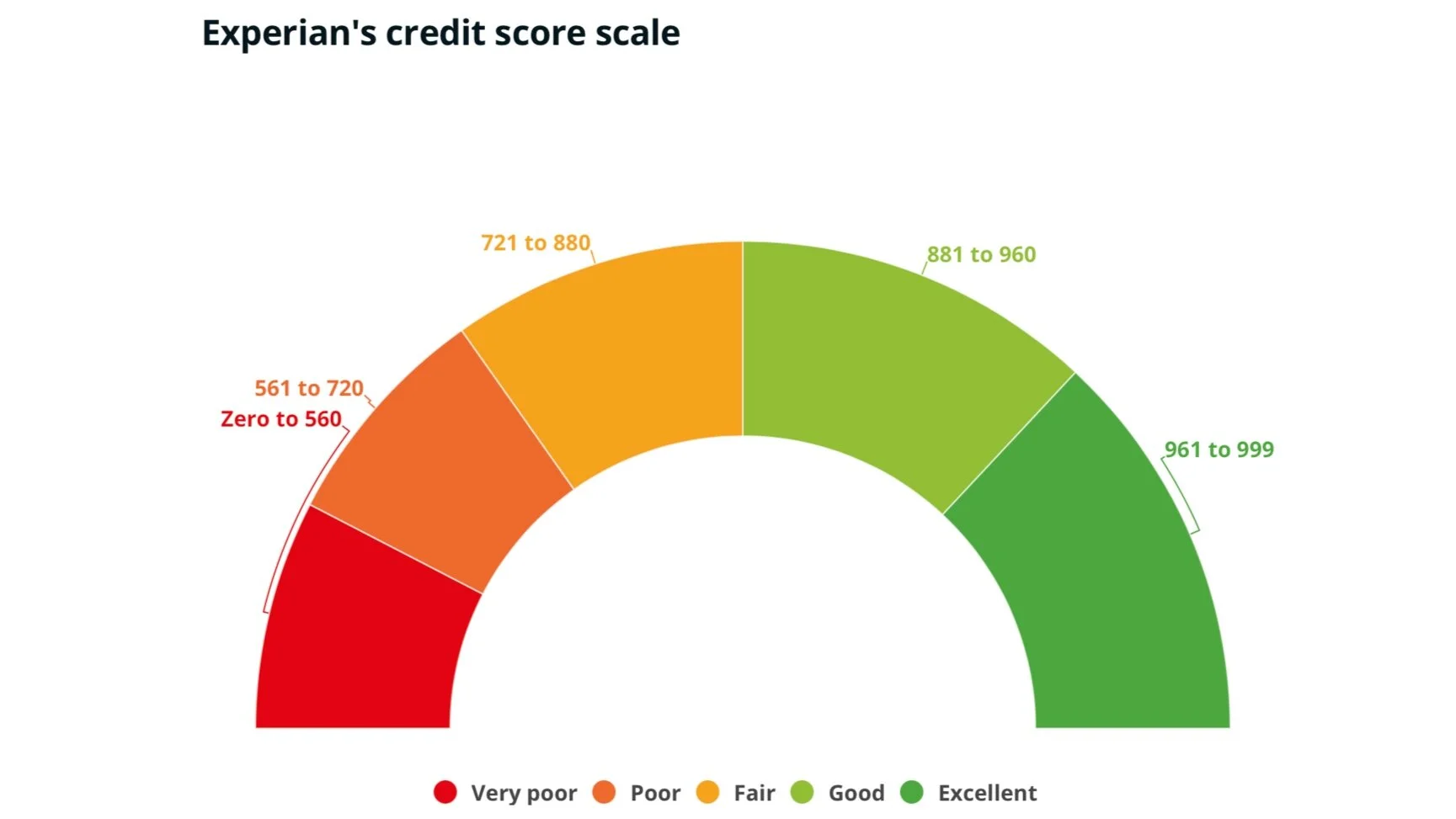

Something to note is that each site has a slightly different scoring scale, so it’s worth noting as one score may not reflect the same on another. For example, Experian uses a scale of 0-999, with very poor being 0-560, poor being 561-720, fair being 721-880, good being 881-960 and excellent being 961-999. Of course, you’d want to aim for the highest score possible, but as long as you’re in the good and excellent range, you have a great shot at being granted credit every single time.

Experian’s credit score: Image from which.co.uk

MoneySavingExpert also has a credit club that allows you to check your Experian score and other insights to help you boost and apply for loans. I haven’t used it myself, but I’ve plugged it above as it seems like a good tool that may be useful to others.

Another site you can use is Equafix/Clear score. It’s not free, BUT it does offer a 30-day trial if you’d like to just check where you stand. Again, I haven’t used this (I stick to Experian as it’s what most lenders use in the UK), but it’s another site people use and may be worth checking if you’d like to compare.

As you can see from the image below, their score is slightly different as it ranges from 0-700: Very poor being 0-278, Poor being 279-366, Fair being 376-419, Good being 420-466, and Excellent being 467-700. There are many other sites you can use but I won’t overwhelm you and the internet is free! All I say is that I use Experian and I don’t have any issues.

Equifax’s credit score scale - Image from which.co.uk

Why do we need a good score?

A good score allows you to access better deals, loans, and offers. It is something that should be of interest if you’re trying to get a mortgage as it will contribute towards the decision of how much the bank is willing to lend (whether it’s 4x your income or even as rare as 6x), how much you’re offered on a credit card (listen, with my first credit card I was offered A LOT - I didn’t even know they lent out so much), exclusive loans and so much more. Ideally, the higher, the better!

How can I improve my score?

I’m glad you asked! Many factors come into play when it comes to your credit score… some that you may not have considered before. Below I will list my top 10 tips on how to boost your score and what you need to do!

Get on the electoral roll! You may already be on it, but if you’re not, get on it! The banks LOVEEE it and it costs you nothing. It validates you and shows that you are a trusted individual.

Register to vote! Again, it is so simple to do, validates your identity, and costs nothing! It doesn’t mean that you HAVE to vote, though most of us would have voted before so this step isn’t necessary… for the rest of you, get on it if you can!

Set up your Direct Debits and ensure you have money to pay them off! It sounds simple but this is where people slip up! Direct Debits are handy as they show a lender that you are reliable and able to pay back at a later date. They come out on a set day of each month but they can really mess up your score if a payment bounces and you’re not on job. If you’re someone who isn’t on top of your finances, you should set it up on a day that you get paid (or the day after) so that you haven’t got time to spend the money before it needs to come out! An example of a Direct Debit is a phone or car bill.

Pay in full where you can! Following up from point 3, PLEASE try to pay off your debts in full where possible. I’m talking to you people with credit cards! It’s easy to pay back a portion when that’s offered to you, but you just end up accumulating debt, and unfortunately, this is what catches a lot of people out! I set up a DD to pay my credit card in full so that I don’t have to worry about missing a payment. Most bank apps will tell you when a DD is coming out so you can always shift funds if need be.

DONT MISS A PAYMENT. In all honesty, this should be at the top since it can be the most damaging to your score. Missed payments are a death sentence to your score and show a lender that you are unreliable and not trustworthy. Why should they give you money when your history shows that you cannot repay the loan? Sometimes this can happen accidentally and eventually, you can fix your score if it was years ago so don’t stress too much if you’re in this boat. It won’t be easy as it contributes highly to your score, but time and improving in other areas as well as this will help boost it back up. People set up Direct Debits for this very reason!

How long is your credit history? What do I mean by this you ask? Well, when you open a bank and stay with them, you build a better rapport… for example, someone who has been with their bank for over 10 years will gain more rewards from them than someone who keeps bouncing from bank to bank. This also applies to closing accounts quickly as it’s harder to assess your financial history and makes you an undesirable candidate. This doesn’t mean that you can’t have more than one account. I know people who have loads of accounts and maintain a great credit history, but the rule of thumb is to keep those accounts open (and active) for a decent length of time.

New credit. Any new contract or loan will temporarily affect your score. This is because for loans such as new phone contracts, a mortgage, a credit card, etc will be running a hard credit check. This will therefore lower your score for a few months (around 60-90 days) so you want to avoid this unless you really need to. Some loans only run a soft credit check such as new employers, some credit cards, and insurance companies. These will not impact your credit score. It’s always worth asking what kind of check will be run if you’re not sure!

* TIP * If you have a few things that require a hard credit check, it’s wise to apply at the same time. This is because your score won’t be affected straight away so any lenders running a check will not see the damage done by another hard check yet. EG, if you wanted to apply for a mortgage and buy a new car or increase your credit limit, it would be best to time them near each-other to optimise your chances of getting the best loan!

If you’d like to know more about hard and soft checks, click here.

Don’t monitor your score too often! As briefly mentioned above, too many checks will negatively impact your score so it’s not wise to check too regularly. Every few months is ideal but I wouldn’t check too often if you can help it! You should check it from time to time to monitor if things have changed or detect suspicious behaviour, otherwise, you should only check before you want to apply for credit.

For those with poor credit history and want to boost it quickly, it may be wise to apply for a credit card BUT be careful. Know how you spend and if you will be able to resist spending money! Remember it is not free money and needs to be paid back. If you think you cannot behave, please do not bother! I promise you I had an excellent score way before I had a credit card so it’s certainly possible! This is just a useful tip for those who want to use it to show that they are responsible enough to lend to!

Leading on from that… Credit utilisation! This is the ratio of your maximum credit and how much you’re using. This is important to note, and I advise you to keep it between 15-25% if you can! Yes, people will say 30% (which is ok) but 20-25% is ideal if you can. For example, If you have a limit of £2000 (credit or arranged overdraft), by limiting your expenditure to 20% (£400) you look like a great candidate as you are staying within your limit and are not a high-risk spender. DO NOT MAX OUT YOUR CARD! Not only does it become super hard to pay it off, but you are a big red flag to your lender. By keeping it low, you show that you can borrow money within your means and pay it back.

Note: This doesn’t mean don’t use your card at all! Borrowing too little can also affect your score (I know, I know). If you have a credit card but don’t want to use it (but also don’t want to close the account yet), I suggest that you use a little bit - maybe instead of paying for petrol on your debit card, you pay it on your credit card or do small shops on it from time to time. These are expenditures that you would use anyway but you just delay the repayment. In doing this you show that you can still borrow and repay but you don’t get sucked into thinking you have money that you don’t! If you spend nothing, you also come across as high risk as you’re not using the money that is being lent. If you don’t want to spend small amounts, it’s best to close the account… just know that it will have a temporary hit on your score when you close the account.

I have an excellent/ good score, but how can I make it perfect?

As I don’t know your individual circumstance, I can’t tailor my reply, though there are things that you can all do that may help boost your score!

Firstly, check all the points above and see which one may apply to you. Maybe you have a credit card or overdraft but you’re using over 30%. Try to bring this down and you’ll see your score improve. Maybe you’ve been opening and closing accounts? Properly evaluate what you’re using and make the necessary adjustments.

Secondly, check your report and see what may be contributing to your score. Perhaps there is something in the past or a marker that may be hindering your growth? It’s worth going for a trial and assessing your full report. Check it a few times to see how your behaviour may be impacting the overall score. Any unusual activity or misinformation, flag it up and get it changed or amended!

Lastly, patience! I know it’s hard, but sometimes you just have to wait it out. I know the feeling of being a few points off perfect and it’s frustrating, but as long as you’re sticking to the points, you’ll eventually make it!

I’m a student, can I still build my credit?

Of course! I accidentally stumbled on some gems that ended up boosting my score without realising! Remember, you don't necessarily need to be balling to have good credit but doing some things will help you significantly!

First and foremost, get an overdraft. When you’re a student this is free and your bank often encourages you to get one. Even if you don’t need one, it’s low risk and can work to your advantage if utilised correctly! Are you listening up? OK…

I know I said avoid overdrafts but an interest-free overdraft could work in your favour if you play it right! Still try to be within 20-30 % of your overdraft if possible (easier said than done for the average student), but for those who can manage their finances well, this is a good tip. When I was at uni my bank gave me an overdraft of £750. There are definitely bigger overdrafts and I’m sure I could have extended mine but in all honesty, I didn’t go too much into it because I was working on the side.

I did, however, allow myself to go into it by £200-ish every now and then and though I could get out of it, I let it stay there until payday and allowed that to bring me out. This allowed me to put some money into savings without having to worry about it affecting your score - it won’t! Since it is an interest-free overdraft, this doesn’t affect your credit and can help build your score as you are effectively showing “borrowing” and paying back… *RJ taps head*

Although it’s easier to get to your max, try to practice staying on the lower scale as this not only helps your credit but also puts you at less risk of having debt once that interest-free cap is lifted! Listen, it’s easy to fool yourself that your interest-free limit stays for a year (or two in my case) after uni, and graduate accounts often allow you some grace with a reduced interest-free amount so that you can ease yourself out before the debt has consequences, but in reality, many still struggle to get out in time and that’s when you run into trouble! Try to get into a good habit whilst you can!

Another thing worth noting is that having your name on utility bills also helps give credit. Again, I didn’t realise this at the time but if an account is in your name (even shared) and the bills are being paid on time because you have trusty housemates (pick wisely - mine were great with payments), then this can be something worth volunteering for. Obviously, missed payments and arrears will not help you at all so please understand there is a risk if you don’t know your housemates like that. You can also have your name on the account but not have it come out of your account (say you had a joint account) - though the name may still do damage if things aren’t paid, at least you won’t be hit with a double whammy for any overdrafts or bounced payments to your bank!

As stated before - signing up for the electoral roll and registering to vote help your score. I think my bank already had me signed up for the electoral roll, but you can also opt-in (or out) here. Secondly, don’t forget to register to vote. You don’t have to actually vote, but again, signing up gives you credibility. You can register here.

Things to note: Don’t forget to close any accounts once you have left uni! Tell companies that you have left the property, have moved, or want to close an account, and make sure you pay off any outstanding balances. That “free” water bill or a bill that hasn’t come WILL come back to bite you in the butt! Make sure you close anything tied to your name that you aren’t using! You’ve got this!

Finally…

So, there you have it! It was a bit of a lengthy post but I tried to give you enough valuable information to help boost your credit score! If you got to the end, thank you for your patience and I do hope you get something from this! It’s not often that you’ll get information like this for free, so the only thing I ask from you in return is to share this with friends and family that may benefit! These are things that I have done myself, and as you can see, I do not cap with my score!

Feel free to leave a comment, or let me know if any of these tips work for you! Remember, all good things take time but if I can do it so can you!

P.s… A score of 999 (if we’re using Experian) is great for bragging, but any score within “Excellent” will give you the same kind of benefits. It doesn’t necessarily mean you’re rich or determine wealth, but hey, I’m happy to be in the elite gang! LOL.

As always, I wish you all the best and I wanna see everyone win this year! Whilst we may be on lockdown, this is a great time to revaluate your finances to set you up for a better year ahead, and every little helps! If you liked this post, feel free to check out my other #MoneyTalk blogs: Let’s talk finance! and info on ISA’s

Liz x